|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

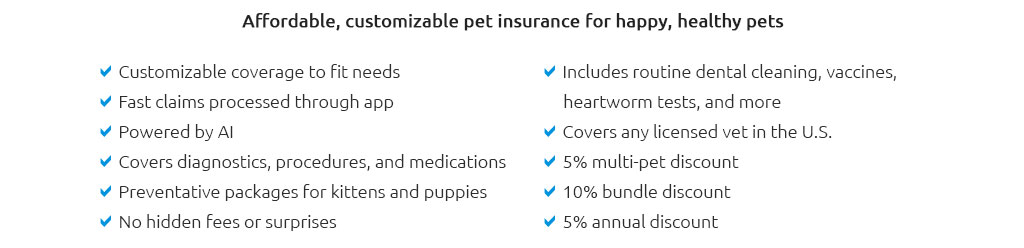

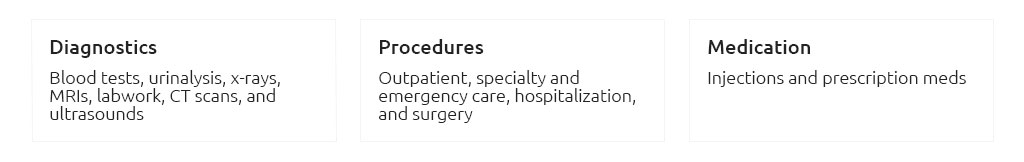

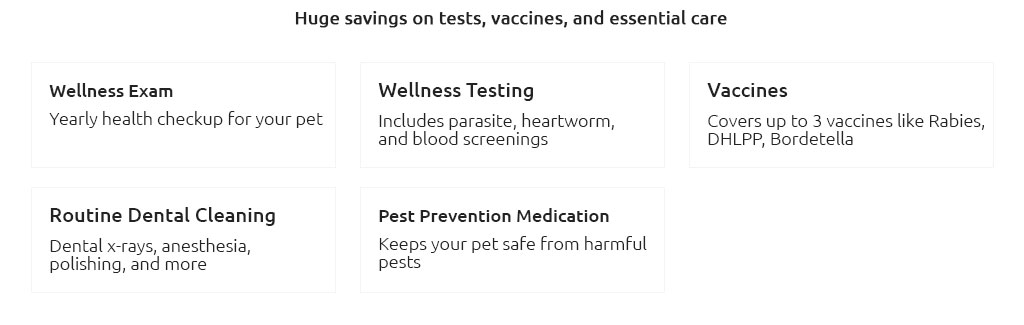

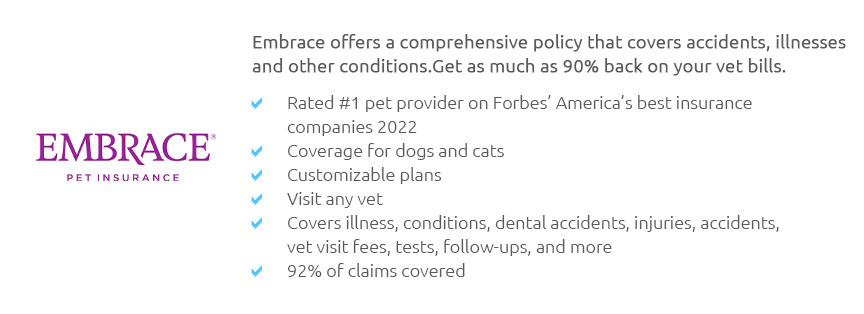

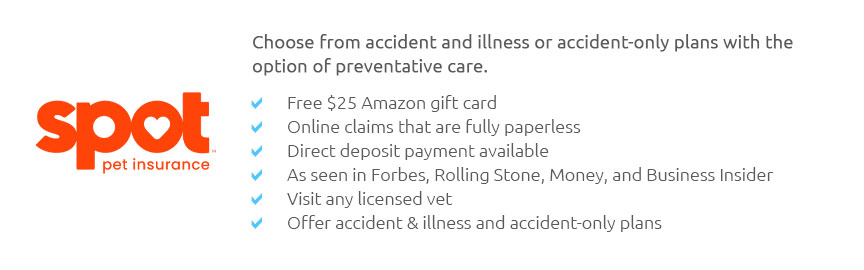

Understanding Dog Medical Insurance: Important ConsiderationsDog medical insurance has become an increasingly popular topic among pet owners, driven by the escalating costs of veterinary care and a desire to ensure the well-being of our canine companions. Pet insurance, much like human health insurance, provides a financial safety net, mitigating the often overwhelming expenses associated with unexpected illnesses or accidents. But before diving into the world of pet insurance, it's crucial to understand its nuances and the various options available. Firstly, one must consider the type of coverage offered. Generally, dog insurance plans fall into three main categories: accident-only, illness, and comprehensive plans. Accident-only policies are typically the most affordable and cover unforeseen incidents such as broken bones or ingestion of foreign objects. On the other hand, illness policies cater to diseases ranging from common infections to chronic conditions like diabetes. Comprehensive plans, though pricier, encompass both accidents and illnesses, offering the most extensive coverage. Another factor worth contemplating is the policy's reimbursement model. Most insurers reimburse a percentage of the vet bill, usually ranging from 70% to 90%, after the deductible is met. Speaking of deductibles, these can be annual, per incident, or even lifetime, each impacting the premium differently. Higher deductibles generally result in lower monthly premiums, but they also mean paying more out-of-pocket before insurance kicks in. It's also vital to scrutinize what is not covered. Pre-existing conditions, hereditary disorders, and routine care like vaccinations or dental cleanings often fall outside the scope of standard policies. However, some insurers offer wellness plans as an add-on, which can help offset routine care costs. Additionally, age limitations may apply, with premiums significantly increasing as pets age, or some companies might not offer new policies for older dogs at all. When evaluating dog medical insurance, one cannot overlook the importance of understanding the claims process. A straightforward, hassle-free claims process can save time and stress. Opt for insurers with a reputation for quick reimbursements and transparent communication. Customer service, often the unsung hero in these scenarios, plays a pivotal role; responsive and empathetic service can make a significant difference during stressful times. Lastly, cost is a pivotal consideration. The price of insurance varies based on several factors, including the dog's breed, age, and location. While some may view insurance as an unnecessary expense, it can offer peace of mind and protect against the potentially prohibitive costs of emergency care. Thus, it's worth weighing the monthly premium against the potential financial burden of not having coverage. FAQs About Dog Medical Insurance

https://www.aspcapetinsurance.com/

Coverage that offers things you'd want and expect for your pet when they're hurt or sick and covers exam fees and costs of diagnostics and treatment for ... https://www.usaa.com/insurance/additional/pet

If you buy a policy through the USAA Insurance Agency, you'll get up to 15% off. Military members and members with service dogs or multiple pets can get an ... https://www.petco.com/shop/en/petcostore/insurance

Our most popular coverage starts at around $90/month for two dogs, which includes a 5% multi-pet discount. Two cats on our most popular plan would cost about ...

|