|

dog medical insurance selection framework for fair, confident decisionsClear choices start with clear comparisons. The goal is simple: match coverage to real risk, pay a fair price, and avoid surprises. What it typically covers- Accidents and emergencies: lacerations, foreign-body ingestion, toxic exposures, bloat, fractures.

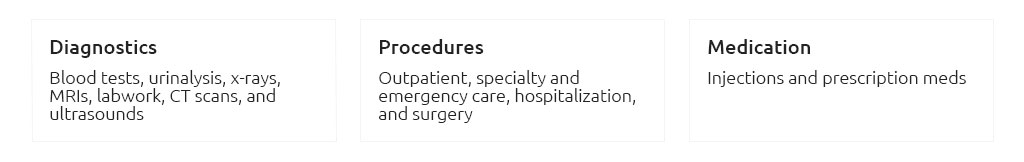

- Illness diagnostics and treatment: bloodwork, imaging (X-ray, ultrasound, MRI), hospital stays, surgery.

- Chronic and hereditary conditions: diabetes, allergies, hip dysplasia - if not pre-existing and after any waiting periods.

- Medications and therapeutic care: prescription drugs, sometimes rehab/physiotherapy if listed.

- Dental accidents: broken teeth from trauma; dental disease coverage varies widely.

Often not covered (or limited)- Pre-existing conditions and symptoms noted before enrollment or during waiting periods.

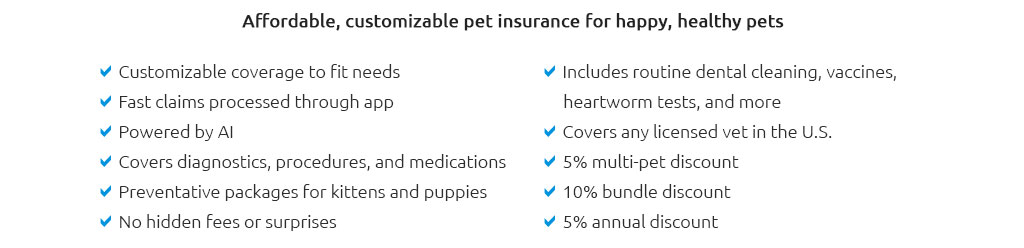

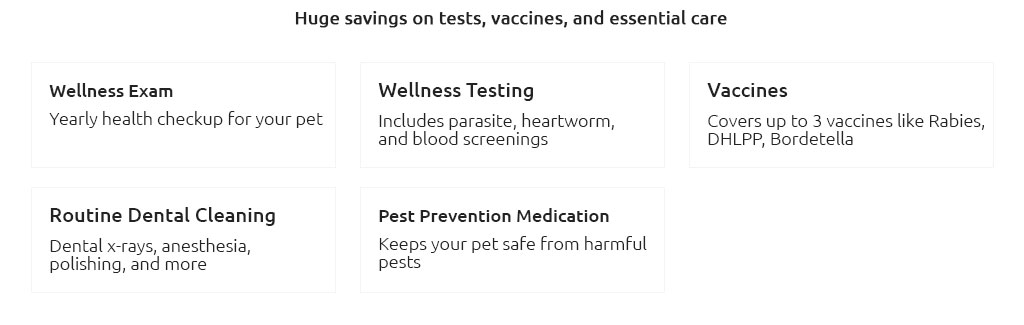

- Routine wellness (vaccines, spay/neuter, flea/tick) unless you buy an add-on.

- Breeding, cosmetic procedures, and experimental therapies.

- Behavioral treatment and prescription food: covered by some, excluded or capped by others.

Plan structures- Accident-only: least expensive, narrow scope; good for major trauma risk, not illness.

- Accident & Illness: the core of medical insurance; breadth varies by policy wording.

- Wellness add-ons: budgeting tools, not risk transfer; evaluate separately.

Fairness matters on both sides: you want predictable rules, the insurer prices for expected risk. Precision in details makes the difference. Variables that change value- Annual limit and sublimits: $5k, $10k, or unlimited; watch for caps on rehab, dental, or cancer.

- Deductible type and amount: annual vs per-condition; $200 - $1000 typical. Higher deductibles lower premiums.

- Reimbursement rate: 70 - 90% coinsurance after deductible. Clarify if exam fees are included.

- Waiting periods: standard for accidents/illness; knees/hips often longer.

- Bilateral and congenital clauses: one-side ACL tear can affect the other; check wording.

- Fee basis: actual vet bill vs "usual & customary" schedules. The latter can reduce payouts.

- Renewal terms and age rules: no new exclusions at renewal? rate increases with age?

- Claims process: app vs email, average payout time, direct pay to ER? Small frictions matter at 2 a.m.

How to compare fairly (a practical sequence)- Fix the profile: same dog (age, breed, ZIP), same start date.

- Normalize settings: choose identical annual limits, deductibles, and reimbursement rates across contenders.

- Price plus outcome: tally 3-year projected premiums and model two claims: a $600 GI upset and a $4,000 surgery.

- Apply rules: simulate with each policy's deductible type, sublimits, exam-fee inclusion, and waiting periods.

- Stress test: add a second large claim in year two to see how annual limits and deductibles interact.

- Document: capture policy definitions, exclusions, and any lifetime/bilateral clauses in a one-page summary.

I pause, briefly, before suggesting "unlimited." It's excellent protection, yet a $10k limit plus a moderate deductible often fits real claim patterns for many breeds. Budget and risk tolerance decide. Costs and expectationsPremiums reflect age, breed risk, and local vet pricing. Rates tend to rise over time because medical inflation and aging are real. - Drivers: large breeds, brachycephalic breeds, older dogs, and high-cost metro areas skew higher.

- Tradeoffs: higher deductible and lower reimbursement can tame premiums without gutting protection for true catastrophes.

- Renewal reality: expect periodic increases; focus on consistency of coverage and transparency of adjustments.

A real-world momentAt 2:10 a.m., my neighbor's Labrador mix showed classic bloat signs and went straight to an emergency hospital. The bill landed near $3,400. Their policy - 80% reimbursement after a $500 annual deductible - covered exam fees and post-op meds. They uploaded the invoice in the parking lot; funds hit nine days later. Not glamorous, just practical relief. Setting limits and deductibles- Value-seeking: $5k annual limit, $500 - $750 deductible, 70% reimbursement. Shields from big shocks with controlled premium.

- Balanced: $10k limit, $500 deductible, 80% reimbursement. Strong for typical surgery costs and overnight care.

- High protection: Unlimited limit, $250 - $500 deductible, 80 - 90% reimbursement. Consider for high-risk breeds or if ER referral centers are your norm.

Fairness principles- Your part: disclose history accurately; share vet records; understand waiting periods.

- Insurer's part: plain wording, no post-claim underwriting surprises, timely decisions, clear adverse-event explanations.

- Resolution: avenues for appeal and external review should be easy to find and use.

Red flags in fine print- Per-incident deductibles on chronic conditions can compound costs.

- "Usual & customary" limits far below local ER rates.

- Bilateral condition exclusions that effectively halve coverage.

- Exam fees excluded, turning small problems into out-of-pocket events.

- Coverage that resets or downgrades at senior ages.

Claims and recordsSave invoices, itemized codes, and discharge notes. Ask your vet to include differential diagnoses and dates of first symptoms. These details shorten review time and reduce back-and-forth. When it might not fitIf you maintain a robust emergency fund, have a low-risk adult dog, or prefer to self-insure predictable costs, you may reasonably skip or choose accident-only. That's a fair choice; the key is making it consciously. SummaryDefine your risk, align comparable plan settings, and test outcomes with realistic claims. Favor transparent terms, steady claims handling, and coverage that meets your dog's actual profile. Pay for protection, not promises.

|

|